Trend Momentum Strategy

Intraday Trading for Gold, Nasdaq 100, Cac 40, Oil, GBPJPY, GBPUSD

Strategy Overview:

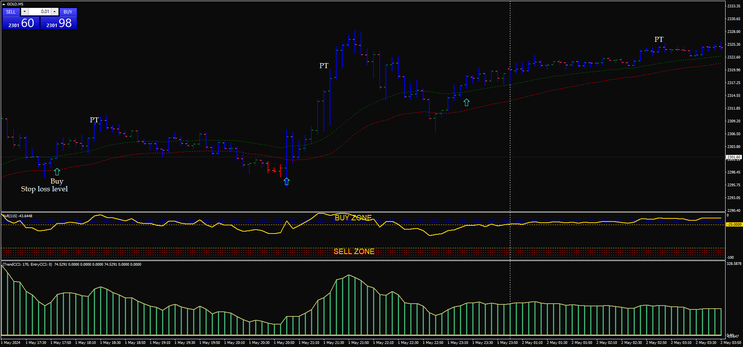

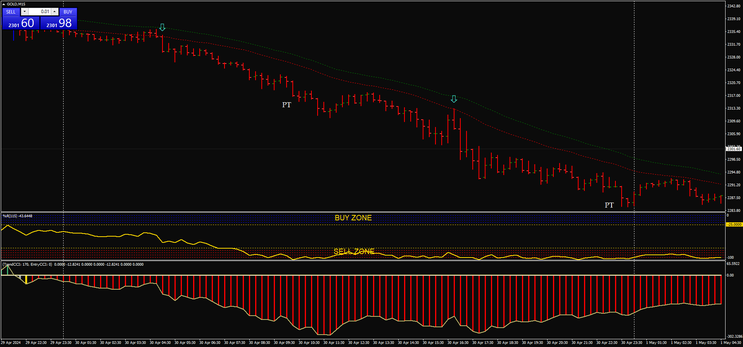

This strategy combines the EMA (Exponential Moving Average) 34 High and Low with the %Williams Range 115 on the close to identify potential entry and exit points for trading gold intraday.

Setup Strategy

3-5-15 minutes.

Currency pairs: Gold, Nasdaq 100, Oil, GBPJPY, GBPJPY

Indicators:

EMA 34 High and Low: These indicators help identify the short-term trend direction and potential support and resistance levels.

CCI Woody (periods, 170) identify the long-term trend

%Williams Range 115 (W%R): This oscillator measures overbought and oversold conditions. But in this case it is used as a trend indicator.

Trading Rules

Long Entry: CCIWoddy green bar and if the price is greater than -25 and crosses above the EMA 34 High.

Short Entry: CCIWoddy red bar and if the price is less than 75 and crosses below the EMA 34 Low.

Exit Rules

Stop Loss: Place a stop loss below the recent swing low for long positions and above the recent swing high for short positions. As an alternative to the fixed stop loss you can use the trailing stop.

Take profit when the price reaches a predetermined target level based on previous swing highs or lows.

Risk Management

Risk no more than a certain percentage of your trading capital on each trade :1%.

Adjust position sizes based on the distance to the stop loss to ensure each trade has a consistent risk-reward ratio.