In this tutorial I show you a practical example of 5-minute time frame scalping on the GBPJPY pair.

Setup Strategy

Currency to be traded: GBP/JPY

Chart timeframe: 5 minutes

RSI setting: 14

Bollinger Bands setting: 20,2,SMA

Step 1

Begin by observing the 5-minute GBP/JPY chart precisely at 00:00. Wait for the Relative Strength Index (RSI) indicator to hit either 70 or 30. The initial RSI reading will determine whether the trade will be a long or short one. If the RSI first reaches 70, the trade will be short. Conversely, if the RSI first reaches 30, the trade will be long.

Step 2

For a short trade, observe the market until it penetrates the lower boundary of the Bollinger Band by 3 pips, then execute the trade at that exact price. For a long trade, watch for the market to penetrate the upper boundary of the Bollinger Band by 3 pips, and initiate the trade at that precise price point.

Step 3

We immediately place out stop loss at 20 pips from entry.

Step 4

We place out take profit order at 25-50 pips from entry price.

5 Day Trade Examples

NOTE: ALL TIMES ARE EST TIME

11th of February 2008 Trade

Example 1

We will quickly go over this first trade example so you can see

how the trade worked out from start to finish on the same chart. Hon

the next trade example I will be more specific in my explanation.

A: 00:00, start time.

B: RSI reaches 30 first. This means we will be looking for a long time trade.

C: We where looking for market to penetrate upper part of

Bollinger band by 3 pips and it did at 207.53. Long trade is

triggered.

D: Stop loss is immediately placed 20 pips from entry at 207.33.

E: Profit target of 50 pips is reached at 208.03.

Example 2

Trade

outcome for 11th of February 2008: +50 pips

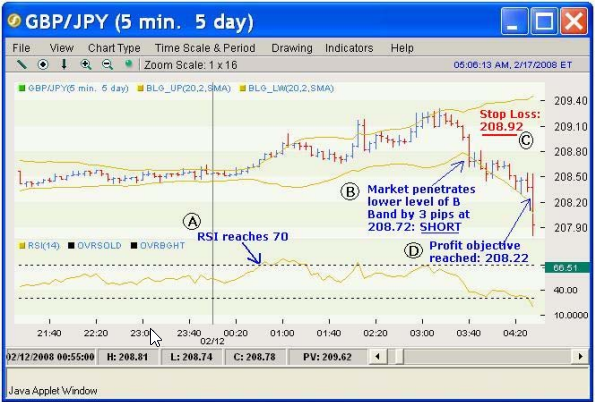

12th

of February 2008 Trade

Ok,

at point A we see the time from where we start to look for the

trade

setup. This is always going to be 00:00. Point B on the chart

shows

us the RSI reading at exactly 00:00, in this case it is 54.26.

Now,

we have to wait for the RSI to either reach 70 OR 30 and

follow

the systems rules. Let’s look at how this trade developed.

Example

3

So,

we can see that at point A the RSI reaches 70. This means that

we

will be looking for a short trade. If it was the opposite and the

RSI

would have reached 30 before we would have been looking for a long

trades.

At

this point the RSI does not concern us anymore and what

matters

now is the market price and the Bollinger band. We are

now

waiting for the market to penetrate the lower part of the

Bollinger

band by 3 pips, and it does so at point B. We enter a

short

trade at 208.72 and immediately place our stop loss 20 pips

from

entry or 208.92 (point C). After stop loss is placed we either

wait

for the market to reach our profit objective of 50 pips or we

enter

a take profit order with our forex broker. At point D we can

see

the market easily reached out profit objective and the trade

turned

out to be a 50 pip winner.

Example

4

Trade

development:

A:

00:00, start time.

B:

RSI reaches 30 first. This means we will be looking for a long time

trade.

C:

We where looking for market to penetrate upper part of

Bollinger

band by 3 pips and it did at 209.89. Long trade is

triggered.

D:

Stop loss immediately placed 20 pips from entry at 209.69.

Market

reached our stop loss and trade got stopped out for a loss of 20

pips.

E:

As per the system rules we re-enter trade at 210.08 (3 pips

penetration

of Bollinger band). On this occasion it was a long trade but could

have been a short trade as well if the opportunity would have

appeared first.

F:

Stop loss immediately placed at 209.88.

G:

Profit target of 50 pips is reached at 210.58.

Trade

outcome for 13th of February 2008: +30 pips

14th

of February 2008 Trade

A:

00:00, start time.

B:

RSI reaches 70 first. This means we will be looking for a short

trade.

C:

As expected the market penetrated the lower part of Bollinger

band

by 3 pips at 212.36. Short trade is triggered.

D:

Stop loss immediately placed 20 pips from entry at 212.56.

Market

reached our stop loss and trade got stopped out for a loss of 20

pips.

E:

As per the system rules we re-enter trade at 212.91 (3 pips

penetration

of Bollinger band). On this occasion it was a long trade but could

have been a short trade again as well if the opportunity would have

appeared first.

F:

Stop loss immediately placed at 212.71.

G:

Profit target of 50 pips is reached at 213.41.

Trade

outcome for 14th of February 2008: +30 pips

Example

6

15th

of February 2008

A:

00:00, start time.

B:

RSI reaches 70 first. This means we will be looking for a short

trade.

C:

As expected the market penetrated the lower part of Bollinger

band

by 3 pips at 212.46. Short trade is triggered.

D:

Stop loss immediately placed 20 pips from entry at 212.66.

E:

Profit target of 50 pips is reached at 211.96.

Trade

outcome for 15th of February 2008: +50 pips

Total

pips achieved between the 11th and 15th of February: +210